Collectible Gold

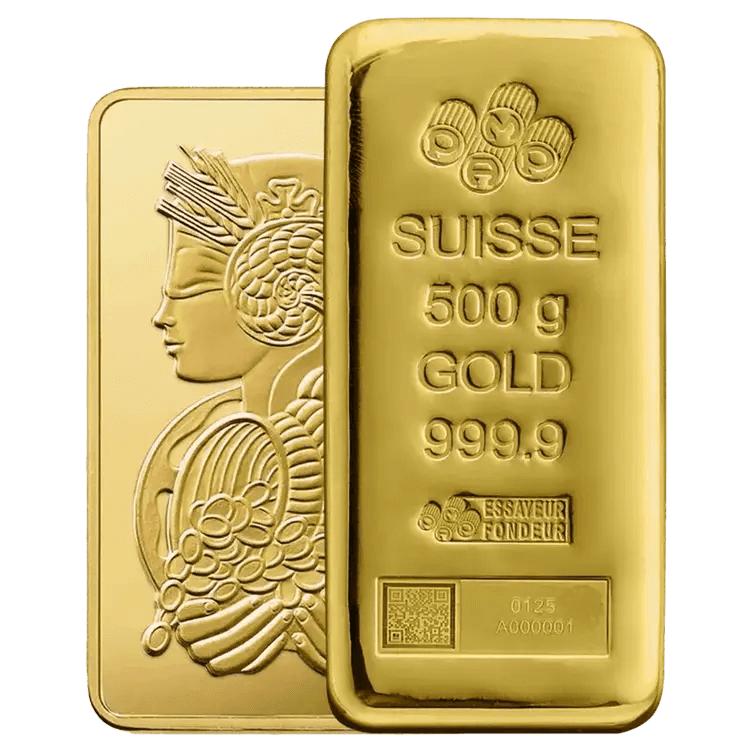

(134 products)Collectible gold encompasses rare coins, bars and gold products that carry historical, artistic, or cultural significance, adding extra value beyond their gold content. Coveted by both investors and collectors, these products are prized for their unique blend of precious metal, rich history, rarity, and craftsmanship – ranging from ancient coins to limited-edition modern pieces, proof coins, and intricately designed gold bars.

What sets collectible gold apart from standard bullion is the numismatic premium – an added value determined by factors like rarity, age, condition, and historical importance. These pieces may be commemorative, too. Collectible gold often increases in value over time as demand rises and availability diminishes, making it an attractive investment option.

What is collectible gold?

While investment gold bullion has ‘intrinsic value’ – the value determined by its gold content and purity – collectible gold often has numismatic and/or commemorative value too.

- Numismatic value is the value attributed to a coin or gold item based on its rarity, condition, age, and historical significance rather than its intrinsic metal content. Collectors and investors seek items with numismatic value because they offer both tangible and intangible qualities that add to their worth. For instance, a Roman gold coin or a U.S. Double Eagle from the early 20th century can command a high numismatic premium.

- Commemorative value refers to items that are minted to mark special events, anniversaries, or notable figures. These items, often limited in mintage and featuring intricate designs, are valued for their artistic and historical significance. Commemorative gold coins are particularly popular with collectors who value their uniqueness and limited availability.

Why invest in collectible gold coins & bars?

There are several reasons why investors might choose collectible gold as part of their portfolio:

- Rarity: Collectible gold coins and bars are often produced in limited quantities or have become rare over time. This scarcity increases their desirability among collectors and investors, leading to potential price appreciation.

- Appreciation potential: Unlike standard bullion, which moves primarily with the price of gold, collectible gold can appreciate based on its rarity and historical significance. As demand for these unique items grows, their value can increase significantly over time.

- Liquidity: High-quality collectible gold items, especially those graded and certified by professional numismatic organisations, tend to have high liquidity. There is a robust market for rare gold coins and bars, allowing investors to sell their holdings easily if necessary.

Types of collectible gold available

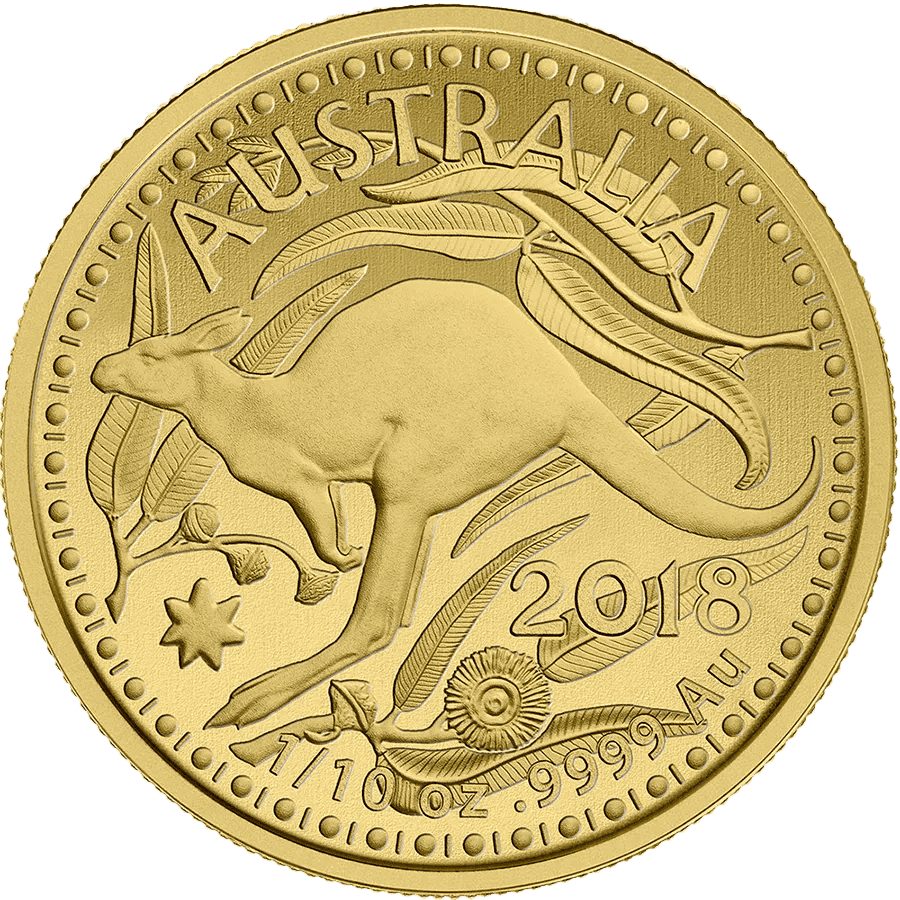

- Limited-edition coins: These are coins minted in small quantities and are often tied to a specific theme or event. Due to their limited supply, they tend to appreciate in value over time.

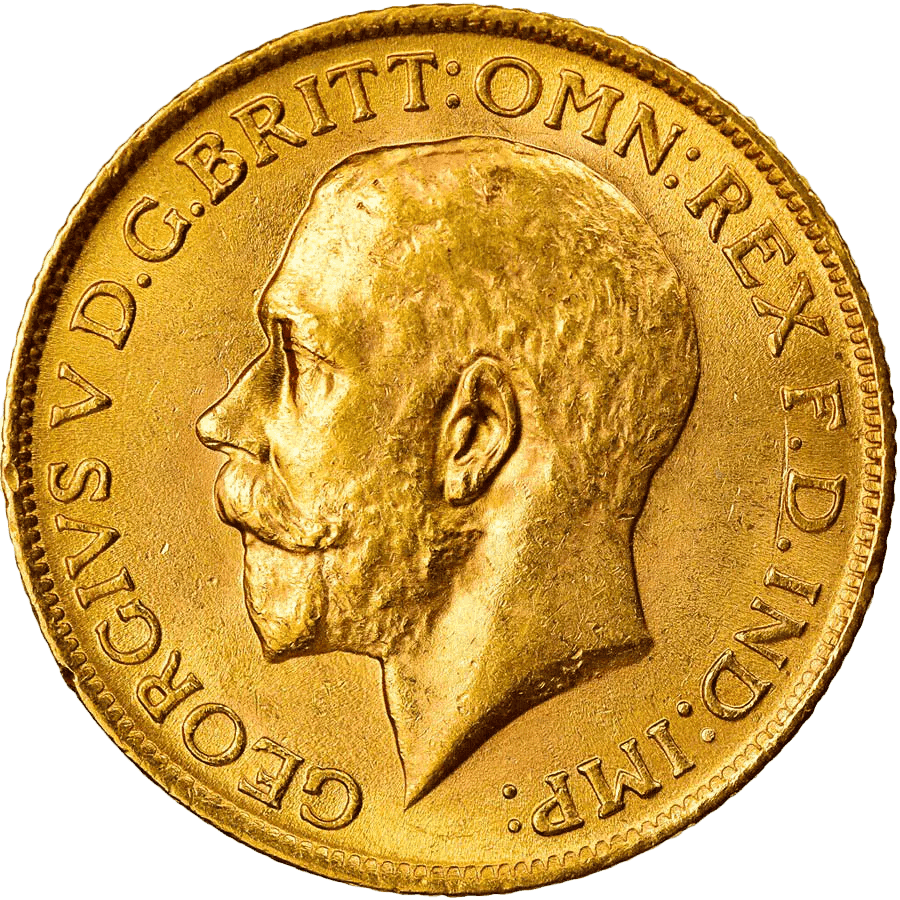

- Historical coins: Coins minted in past eras, such as ancient Greek, Roman, or medieval European coins, carry significant historical and cultural value. These items are prized for their connection to important historical events and their rarity.

- Proof coins: Proof coins are specially struck using a high-quality minting process that gives them an exceptionally fine finish and detail. These coins are often made in limited numbers and are highly collectible for their superior craftsmanship and rarity.

Five popular collectible gold products

American Gold Eagle – A highly sought-after gold coin, known for its beautiful design and strong collector demand.

South African Krugerrand – One of the world’s most recognised gold coins, valued for its long history and global popularity.

Canadian Gold Maple Leaf – Renowned for its high purity (99.99% gold) and intricate maple leaf design.

Gold Sovereign – A historic British gold coin with a long-standing numismatic value, popular among collectors for its royal imagery.

Swiss Vreneli Gold Coin – A limited-edition Swiss coin, prized for its detailed artwork and historical significance.

How to buy collectible gold safely

Purchasing collectible gold can be rewarding, but it's important to take precautions to ensure the authenticity and quality of your investment. Here are some tips for buying collectible gold safely:

- Verify Authenticity: Always ensure that the gold coin or bar you're purchasing is authentic. Look for items that are certified by reputable numismatic organisations like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC). These organisations grade coins and provide certification of authenticity, giving you confidence in your purchase.

- Buy from Reputable Dealers: Whether you are buying online or in person, make sure to purchase from a trusted dealer with a good reputation. Check for reviews and testimonials from previous customers. Many reputable dealers also offer buy-back programs, which can provide added security if you ever wish to sell your gold.

- Understand Pricing: The value of collectible gold is determined not only by its gold content but also by its numismatic or commemorative premium. Be sure to research the market value of similar items to ensure you're paying a fair price.

- Secure Your Purchase: When buying valuable collectible gold, it’s important to secure your investment. Store your items in a safe deposit box or a secure home safe. Additionally, consider obtaining insurance to protect against theft or damage.

Frequently Asked Questions (FAQs)

- What makes gold coins collectible?

Gold coins are considered collectible due to their rarity, historical significance, artistic design, or limited mintage. These factors make them desirable to collectors beyond just their gold content. - How is collectible gold different from investment-grade gold?

Collectible gold has a numismatic premium based on rarity, history, and condition, while investment-grade gold is valued mainly for its gold content. Collectible gold can appreciate due to these additional factors, whereas investment-grade gold follows the gold market price. - Do collectible gold coins appreciate in value over time?

Yes, collectible gold coins often appreciate in value due to increasing rarity and demand among collectors. The appreciation can exceed the rise in gold's spot price, especially for rare and well-preserved coins.

Related categories

Filters

Metal Type

Product Family

Product Type

Collections

View more

Product Selection

Price

Weight

View more

Brands

View more